France

Italy

Spain

Portugal

Greece

Belgium

Morocco

Switzerland

Senegal

Île-de-France

Ardeche

Bretagne

Centre-Val de Loire

Corsica

French Riviera

Hautes-Alpes

Languedoc-Roussillon

Provence

Tarn

Como Lake

Lazio

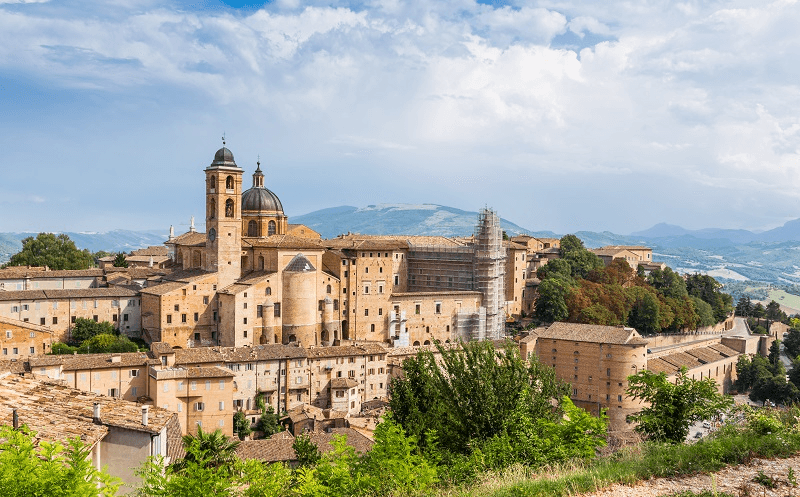

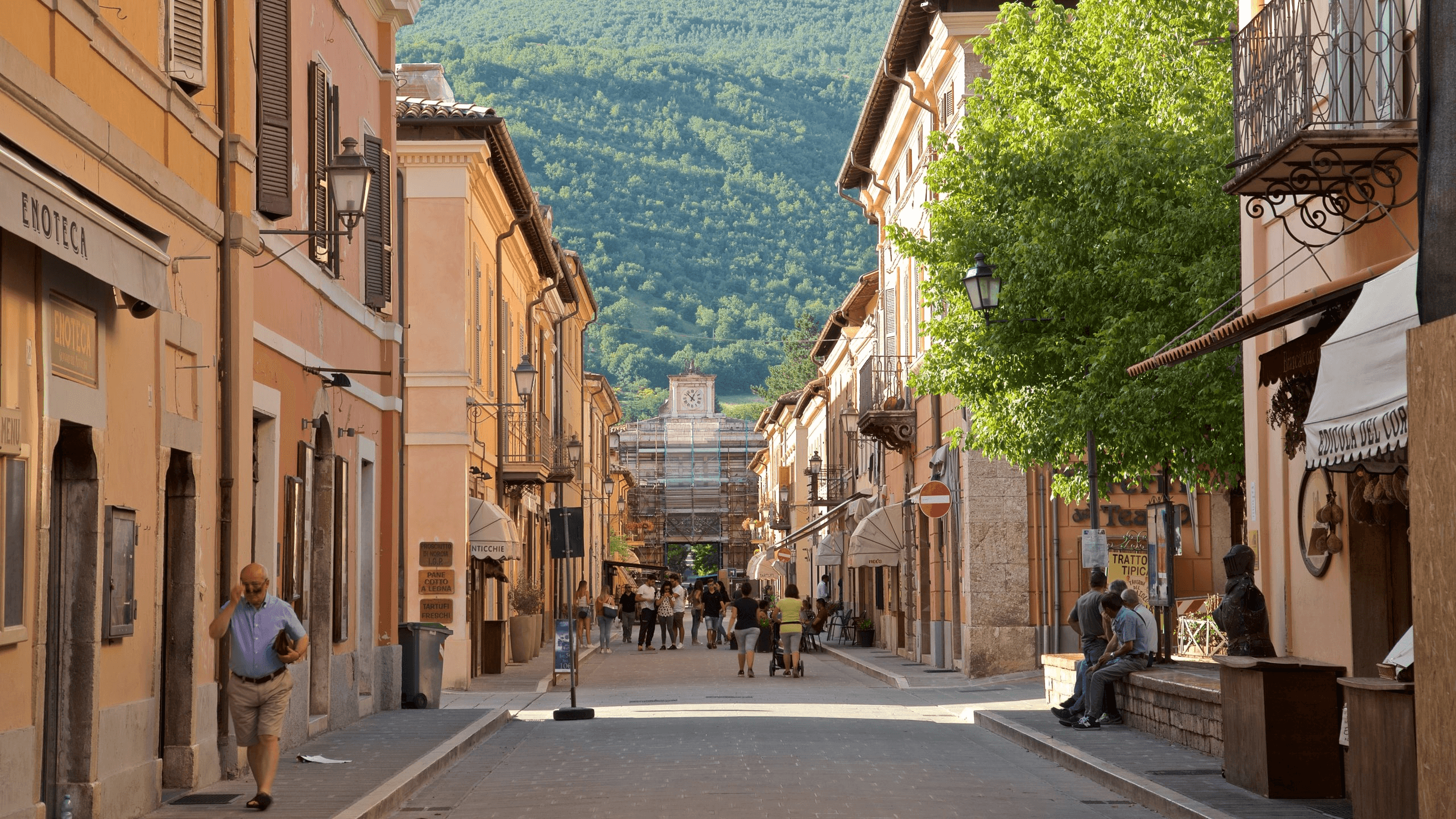

Le Marche

Lombardy

Piemonte

Puglia

Salerno

Sicily

Tuscany

Umbria

Costa Blanca

Costa Brava

Costa Calida

Costa de Almería

Costa De La Luz

Costa Del Sol

Costa Dorada

Ibiza

Algarve

Porto

Silver Coast

Paros

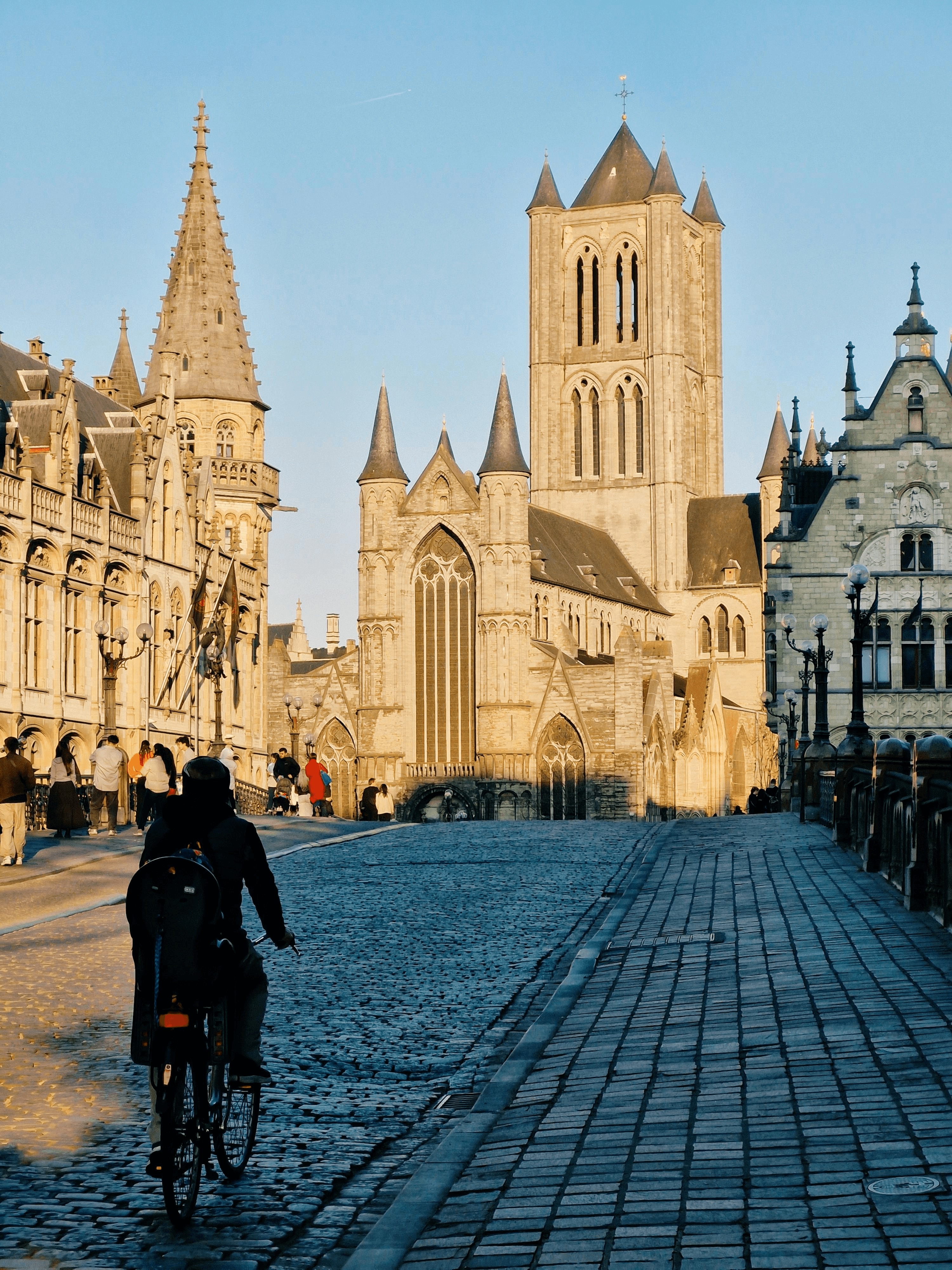

East-Flanders

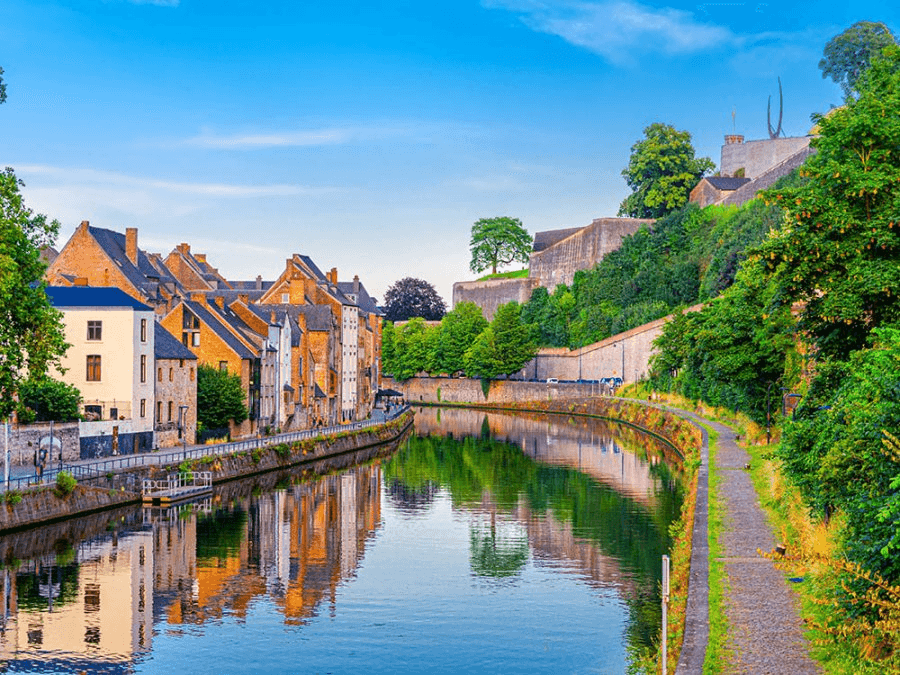

Namen

Essaouira

Marrakech

Canton of Valais

Saly

Destinations

Search your vacation rental

Start your vacation here

Adults

18 years or older

-

+

Children

2 - 17 years

-

+

Babies

Younger than 2 years

-

+

Pets

Dogs are allowed

-

+

View vacation rentals

Recently viewed

Template not found

No template found for blueprint:

Title: